The U.S. government’s decision to elevate potash – a key fertilizer ingredient – to the official list of “critical minerals” marks a quiet turning point in how we think about agriculture and national security. Potash, a potassium-rich salt vital for crop production, might seem an unlikely candidate for a minerals list typically dominated by high-tech metals. Yet its new status, driven by a Trump-era executive order, signals mounting concern that America’s food system could be a strategic vulnerability. In an era of geopolitical turbulence and supply chain shocks, even fertilizer has become a matter of statecraft.

In this long-form feature, we examine why potash is now considered critical and what that means for U.S. agriculture. We’ll explore the data and geopolitics behind the move, how it affects fertilizer supply chains and farm input costs, and what it portends for American farmers, ag retailers, policymakers, and agtech investors. We’ll also look at the global potash supply dynamic – notably U.S. reliance on Canada, and the shadow cast by Russian and Belarusian exports – and consider the prospects for producing potash closer to home. Finally, we’ll touch on other agriculture-relevant minerals on the critical list and situate these developments in broader debates about food security, climate resilience, and national security.

Table of Contents

ToggleWhy Potash Is Now Considered a Critical Mineral

In late 2020, then-President Donald Trump issued an executive order explicitly designating potash as a critical mineral for the United States. This move was unusual – potash (potassium chloride, used in fertilizer) isn’t a rare earth or strategic metal commonly associated with defense or electronics. Instead, the rationale was grounded in agricultural security. Potash is essential for plant growth and has no practical substitute in food production. The U.S. Geological Survey (USGS) had listed potash as a critical mineral in 2018, but it was dropped from the 2022 update to the list, reportedly because policymakers assumed supply was secure. Trump’s order sought to reinstate potash’s critical status, emphasizing that dependable fertilizer supply is as strategically important as any tech mineral when it comes to feeding the nation.

Data underscores the point. The United States relies on imports for roughly 90% of its annual potash consumption. In other words, domestic mines provide well under 10% of what U.S. farmers need. Ed Thomas, Vice President of Government Affairs at The Fertilizer Institute (TFI), noted starkly that “we only produce about 0.2% of the potash here in the United States” – effectively almost nothing – and warned that if overseas suppliers “decided to interrupt supply chains, we could be in big trouble as far as producing food for our own country”. While the 0.2% figure may be an industry exaggeration (USGS puts U.S. production at closer to 7–9% of consumption), the dependency is extreme. By comparison, the U.S. is largely self-sufficient in nitrogen and phosphate fertilizers, importing only a small share of its nitrogen (6–13% of consumption in recent years) and phosphate needs. Potash is the glaring exception among the major crop nutrients.

Why does this heavy import reliance make potash “critical”? The concern is that any major disruption to potash supply would immediately imperil U.S. crop yields and food production. Farmers cannot switch crops to ones that need no potassium, nor can potash be easily sourced from alternative inputs; it’s a fundamental nutrient for virtually all soils and crops. “Any disruption, intentional or accidental, in our potash supply could severely compromise our nation’s food production capabilities,” Thomas cautioned. In short, potash is to farming what semiconductors are to electronics – a small input that has outsized importance, and whose absence would cripple the system. Designating potash as a critical mineral is an acknowledgement that food security and national security are inextricable, and that stable fertilizer supplies are a strategic priority.

Fertilizer Supply Chains and Agricultural Security

The critical mineral designation is more than symbolic; it nudges government agencies to prioritize potash in policy and permitting. In practical terms, this can accelerate mining permits and reduce regulatory hurdles for domestic potash projects. The goal, as TFI’s Thomas stated, is “to spur domestic production” and “open up permitting reform to eliminate hurdles” for U.S. mines. By elevating potash’s strategic importance, federal agencies are now directed to streamline reviews for new potash extraction ventures and even consider invoking the Defense Production Act or other funding tools to support production. The Department of Energy, for instance, has stepped in with a $1.26 billion loan guarantee to help finance a major new potash mine in Michigan – a project expected to produce 800,000 tons per year and supply about 10% of U.S. demand. Such support was virtually unheard of for fertilizer projects until potash’s newfound critical status underscored the link between a robust domestic fertilizer supply and the nation’s resilience.

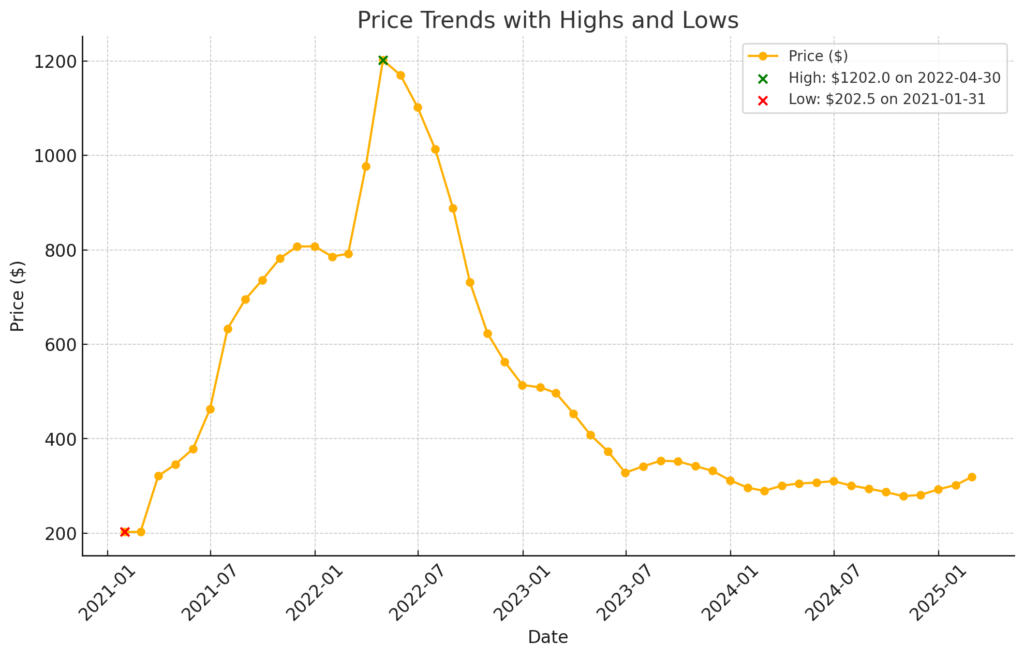

For American farmers, who ultimately depend on these supply chains, the critical mineral policy could be a double-edged sword in the short run and a lifeline in the long run. On one hand, recognizing potash as critical is a clear signal that Washington is paying attention to farmers’ input costs and vulnerabilities. It comes after a period of extreme fertilizer price volatility that saw potash prices skyrocket in 2021–2022, contributing to the biggest farm expense shock in decades. (See Figure 1 for recent potash price trends.) By treating fertilizer inputs as strategically important, policymakers are more likely to build cushions against future price spikes – whether through maintaining strategic reserves of key minerals, coordinating trade agreements to secure supply, or investing in domestic capacity to ease bottlenecks. The Michigan potash project, once online, could modestly reduce U.S. reliance on imports and insulate Midwestern farmers from some global supply swings.

Figure 1. Volatile potash fertilizer prices in recent years, FOB Vancouver standard grade (USD per metric ton). Prices surged above $1,200/ton at the peak of the 2022 supply shock, then fell below $300/ton by late 2023. Such extreme swings in fertilizer costs have rippled through farm economics worldwide.

On the other hand, simply declaring potash “critical” doesn’t immediately lower fertilizer bills for farmers. In 2022, U.S. growers faced record-high fertilizer prices, with potash often costing two to three times its normal rate due to global turmoil. That pain has subsided as prices “normalized” in 2023, but input costs remain a top concern on the farm. The critical mineral policy shift won’t directly subsidize fertilizer; if anything, by highlighting import dependence, it could even justify trade restrictions or tariffs to pressure foreign suppliers – policies that sometimes backfire on farmers by raising prices. Indeed, an earlier chapter of U.S. trade policy offers a cautionary tale: in 2018, amid broader trade disputes, the U.S. briefly threatened 25% tariffs on fertilizer imports from Canada, including potash. A University of Illinois report warned this could add over $100 per ton to potash prices paid by American farmers. Farm groups like TFI strenuously lobbied to exempt Canadian fertilizer from tariffs, and the worst-case tariffs were delayed and averted in that instance. The lesson is clear – policy intended to bolster security can boomerang if not carefully calibrated. Going forward, policymakers will have to balance any protective measures (like encouraging domestic sourcing of potash) against the immediate need to keep fertilizer affordable. Agricultural security depends on both availability and price stability of inputs.

For ag retailers and input suppliers, the critical mineral designation could bring a welcome stability to supply chains. Retailers remember the scramble of spring 2022, when sanctions and war suddenly made it difficult to source potash and other fertilizers at any price. If the U.S. government invests in more local production or at least coordinates reliable import channels, retailers are less likely to face empty warehouses or rationing of fertilizer in peak planting season. Reduced regulatory barriers might also enable innovative fertilizer production – for example, more companies processing domestic brine or mining lower-grade sources – which could diversify the supply base. Ultimately, a more resilient potash supply chain means ag retailers can plan inventory with more confidence and farmers can count on fertilizer being there when they need it, at predictable prices.

Global Potash Supply: Geopolitics and Reliance on Canada, Russia, Belarus

Underpinning America’s potash vulnerability is the geographic concentration of global supply. Potash is produced in meaningful quantities in only a dozen or so countries worldwide, and just three of those countries – Canada, Russia, and Belarus – account for roughly 70% of world output. This concentrated supply makes the potash market inherently prone to geopolitical and logistical disruptions. For the U.S., it creates a stark reliance on a handful of sources, some friendlier than others.

Canada is by far the dominant supplier of U.S. potash. Between 2019 and 2022, about 77% of U.S. potash imports (by volume) came from Canada. Saskatchewan’s vast potash mines, the largest known reserves on the planet, have long been a secure and stable source for American farmers. Canada’s status as a close ally eases many national security worries – there’s little political risk of Canada weaponizing fertilizer exports. However, relying on a single source, even a friendly one, poses its own form of risk. Recent events showed that supply disruptions can happen even without political conflict. In early 2022, Canada’s cross-border trucking was hampered by protests and vaccine mandate disputes, delaying fertilizer deliveries. Around the same time, a Canadian Pacific Railway strike in March 2022 temporarily halted potash shipments out of Canada. And in mid-2023, a port workers’ strike in Vancouver shut down export terminals for weeks, forcing some Canadian mines to curtail production. None of these incidents reflected ill will from Canada, yet they exposed the fragility of having “all our eggs in one basket”. U.S. buyers essentially had nowhere else to turn on short notice. These episodes lend weight to the argument that even friendly dependence is still dependence, and that diversified sourcing or domestic reserves are needed to cushion U.S. agriculture from unforeseen shocks.

Beyond Canada, the global potash market has been roiled by the saga of Russia and Belarus, the second- and third-largest producers. In normal times, the U.S. imported a smaller share of potash from these countries (about 11% from Russia and 6% from Belarus, on average, prior to 2022). But today, direct U.S. imports from Russia/Belarus have virtually ceased – a result of sanctions and the geopolitical fallout of Belarus’s repression and Russia’s war in Ukraine. In 2021, the U.S. and EU imposed sanctions on Belarus’s state-owned potash company (Belaruskali), effectively blacklisting one of the world’s top suppliers. Then Russia’s invasion of Ukraine in 2022 led to further sanctions and export dislocations. Belarus, which once supplied 20% of the global potash market, suddenly lost access to its main export port in Lithuania and had to jury-rig new routes through Russia. Its exports plummeted in many markets – for instance, sales to India and the European Union collapsed after 2022. Russia, for its part, was not officially sanctioned by the U.S. for fertilizer (to avoid causing food shortages), but Russian potash exports were curtailed by indirect hurdles: shipping insurers withdrew, Baltic shippers stopped service, and some importers shunned Russian product. The combined effect of sidelining these two giants was a massive supply shock in 2022, with roughly 40% of global potash export capacity suddenly in question.

Initially, this shock drove fertilizer prices to stratospheric levels – potash spiked above $1,000 per ton in spring 2022, more than triple its price a year earlier. However, the crisis also triggered market adaptations. Other producers (like Canada) ramped up output where possible, and Russia/Belarus found workarounds to sell into non-Western markets. By late 2022 and 2023, increased shipments from Russia and Belarus to willing buyers in Brazil, China, and elsewhere helped stabilize global potash availability. Brazil, a major agricultural powerhouse that imports 96% of its potash, pivoted to buy more from these Eurasian sources as Western nations cut them off. The flow of potash reorganized: less to the U.S. and EU, more to Asia and South America. In turn, global prices gradually came down from their peak (Figure 1 illustrates this normalization). For American farmers, the good news was that potash became more affordable again by 2023; the bad news is that the global supply structure is now more uncertain and fragmented. The U.S. cannot readily count on emergency shipments from places like Belarus as it might have in the past – those avenues are politically closed. This puts even more onus on Canada (and a few smaller allies like Israel and Jordan) to meet any demand surges.

Geopolitically, potash’s critical status also reflects a forward-looking worry: food security as a lever of power. Just as Europe learned the hard way about dependence on Russian natural gas, the West has become wary of dependence on hostile actors for fertilizer. If, for example, Russia decided to outright ban fertilizer exports as a form of retaliation (something it has toyed with via export quotas), it could send grain prices soaring and destabilize countries reliant on imported food. By securing its own fertilizer supply, the U.S. aims to be less vulnerable to such tactics. It’s telling that other nations have also labeled potash a strategic material: India, New Zealand, and Canada each classify potash as critical to their national interests. These are countries acutely aware of how fertilizer shortages would threaten their food systems. In India, for instance, the government must ensure inexpensive fertilizer for millions of small farmers; potash is deemed critical because a cut-off could spark both economic and social turmoil. The U.S., with its vast farm sector and role as a food exporter, is no less concerned – a collapse in domestic crop yields due to fertilizer scarcity would not only hurt Americans but also reverberate through global grain markets.

To summarize the global picture: the potash supply chain stretches across friendly borders and fraught ones, and recent turmoil has underscored the need for resilience. Canada remains a linchpin of U.S. supply (and will become even more so as a huge new mine, BHP’s Jansen project, comes online in 2026 with 8+ million tonnes annual capacity). But even allies have labor strikes and logistical bottlenecks. Meanwhile, reliance on adversarial or unstable countries is a gamble that U.S. policymakers no longer want to take. This is why bringing potash back onto the critical minerals list – after it was mistakenly removed in 2022 – has been applauded as “significant for bolstering U.S. agricultural resilience and enhancing national security”. It aligns America’s mineral strategy with a fundamental truth: in the 21st century, food security is as strategic as energy or defense. And securing food security means securing fertilizers like potash.

Can the U.S. Produce Its Own Potash? Domestic Potential and Feasibility

One of the most intriguing implications of potash’s critical designation is the question of domestic production. If potash is so essential and imports are risky, why can’t America mine more of its own? The U.S. does have potash deposits – in fact, it has enormous resources on paper – but unlocking them is a complex economic proposition.

Today, U.S. potash production comes from a few operations in New Mexico and Utah, accounting for only a few hundred thousand tons per year. These are legacy mining areas (the Permian Basin in New Mexico and ancient salt lakes in Utah) that have been in operation for decades. They produce mainly specialized products like sulfate of potash (for chloride-sensitive crops) and a bit of standard muriate of potash. Even running at full tilt, these mines supply less than 10% of U.S. farmers’ potash needs. The remaining 90% must be imported – a fact unchanged for years. Closing that gap would require a massive scale-up of domestic mining, essentially an American potash industry on the scale of Saskatchewan’s. Is that realistic?

Geologically, the answer is possibly yes. The USGS estimates that domestic potash resources total about 7 billion tons – more than enough to meet centuries of demand. The catch is that most of it lies very deep underground or in deposits that have not been economically viable to exploit. The richest U.S. potash deposits are extensions of the Canadian potash basin that run into North Dakota and Montana. However, much of this potash is 1 to 3 kilometers beneath the surface, making it expensive to reach with conventional mining (Saskatchewan’s big mines, by contrast, are in geologically favorable spots just within reach at ~1 km depth). Other deposits exist in places like the Paradox Basin of Utah, central Michigan, and the Holbrook Basin in Arizona. These too tend to be very deep or lower grade. For decades, cheap imports undercut the incentive to invest the billions of dollars that would be needed to develop these domestic sources.

Now, with potash elevated as a strategic resource, the calculus is shifting. The Michigan Potash Project is a case in point. Located in Osceola County, Michigan atop a significant deposit 8,000 feet underground, this project languished for years seeking financing. After the critical mineral push, it secured that $1.26 billion federal loan guarantee in 2025, putting it on track to become the first new American potash mine in over 50 years. If completed, it will use solution mining (pumping water underground to dissolve potash and bringing it to the surface) – a modern technique that minimizes surface disruption – and could supply around 8–10% of U.S. demand. That’s a start. Other companies are exploring projects in North Dakota and Utah, buoyed by the promise of streamlined permitting and government support.

However, economic feasibility remains the elephant in the room. Building a potash mine is expensive – often a multi-billion-dollar, decade-long endeavor – and the market price of potash is notoriously cyclical. The boom in prices during 2022–2023 might make projects look profitable now, but if prices slump for a prolonged period (as they did in the late 2010s), investors could get skittish. For example, BHP’s giant Jansen mine in Canada was debated for years because of worries of oversupply; it only moved forward once demand projections convinced investors it would be needed. Similarly, any U.S. project must compete on cost with huge Canadian and Russian mines. Some new entrants tout lower production costs thanks to tech innovations – e.g. one preliminary assessment claimed it could produce potash in the U.S. for around $61/ton operating cost, not far off from established producers – but these figures remain to be proven at scale.

It’s also worth noting that environmental and regulatory hurdles pose challenges. Potash mining, especially via solution extraction, requires significant water usage and has to manage brine waste. Local opposition can arise if people fear groundwater contamination or land subsidence. Stringent U.S. environmental reviews (e.g. under NEPA and water protection rules) mean projects take many years to permit – one phosphate mine expansion in Florida spent over a decade and $20 million in permitting and is still not approved. The critical mineral status could help here by making agencies coordinate and prioritize these permits, but it doesn’t eliminate environmental standards. TFI and others are advocating for NEPA reforms to accelerate potash and phosphate projects specifically. In the best case, domestic potash production can be expanded significantly over the next 5–10 years, but realistically the U.S. will remain partially import-dependent for the foreseeable future. The critical mineral policy is about tilting the trajectory – from 95% import-dependent to maybe 70–80% in a decade – rather than total self-sufficiency overnight.

In economic terms, a modest increase in domestic production could still have outsized benefits: even if U.S. mines supplied, say, one-quarter of the country’s needs by 2035, that additional supply could act as a buffer against import disruptions and give the U.S. more leverage in global trade. It could also create rural mining jobs and industrial activity at home. The critical minerals push essentially asks: What is the premium we are willing to pay for security? If domestic potash is somewhat more expensive than imports, is it worth it for the insurance policy it provides? Washington’s current answer seems to be yes – at least to a degree. Loans, faster permits, and perhaps tax incentives are being marshaled to close the viability gap for select projects. The outcome will depend on whether these nascent projects can deliver potash at competitive costs and on whether the global market remains tight enough to justify continued investment.

Beyond Potash: Other Critical Minerals in Agriculture

Potash isn’t the only input on the minds of agriculture watchers. The U.S. critical minerals list (last updated in 2022) mainly features materials for energy, electronics, and defense – lithium, rare earths, nickel, cobalt, and so on. Most aren’t directly tied to farming. However, a few critical minerals have clear agricultural relevance, either as fertilizer components or as essential nutrients for crops and livestock:

- Phosphate (Phosphorus): Although not on the official 2022 list, phosphate rock is arguably as critical as potash for agriculture. Phosphorus fertilizers (like DAP and MAP) are one of the “N-P-K” trinity of crop nutrients. The U.S. has decent phosphate reserves (mainly in Florida, North Carolina, and Idaho), but they are finite and becoming harder to mine. TFI has flagged that U.S. phosphate reserves could be depleted in about 50 years at current usage. Already, about 27% of U.S. phosphate fertilizer supply (especially processed products) is imported, with countries like Saudi Arabia, Morocco, and Jordan among key sources. This import reliance is expected to rise as domestic mines face depletion and environmental limits. Moreover, global phosphate trade has seen its own disruptions – for instance, China (the largest producer) imposed a ban on phosphate fertilizer exports in 2021 to protect its domestic supply, and Russia (another major exporter) briefly restricted exports as well. These actions sent shockwaves through fertilizer markets, not unlike the potash situation. Thus, many are calling for phosphate to be added to the U.S. critical minerals list alongside potash. Doing so would underscore the need for resilient phosphorus supply chains – whether through developing lower-grade domestic deposits, encouraging recycling of phosphorus (from animal manures or food waste), or securing reliable import partnerships. Phosphate is the next domino after potash in the campaign to secure fertilizers.

- Nitrogen: Nitrogen isn’t a mineral in the geological sense (it’s synthetically produced from the air via the energy-intensive Haber process), so it doesn’t appear on the critical minerals list. However, it’s worth mentioning because nitrogen fertilizer availability is absolutely critical to agriculture and has been a source of volatility. The price of nitrogen fertilizers (like ammonia, urea, and nitrates) is tightly linked to natural gas prices, since gas is the primary feedstock. In 2021–2022, spiking natural gas costs in Europe caused ammonia plants to shut down, contributing to record-high nitrogen prices worldwide. Russia’s war in Ukraine compounded this, as Russia is a major exporter of ammonia and urea (and of natural gas). American farmers saw anhydrous ammonia prices surge to well over $1,400 per ton in 2022 (from around $500 in 2020), which was even more dramatic than the potash price spike. The U.S. is actually a large producer of nitrogen fertilizer and less import-dependent in volume terms, yet because fertilizer is a globally priced commodity, domestic prices still soared with the world market. While nitrogen will never be on a “minerals” list, the lesson for policy makers is similar: enhancing energy security and petrochemical capacity (for example, keeping natural gas abundant and affordable, and having the ability to surge fertilizer production) is part of agricultural security. Some efforts are underway to develop green ammonia (made from renewable energy) which could diversify production and cut the carbon footprint of nitrogen fertilizer – a two-birds-one-stone for climate and supply resilience.

- Zinc: Zinc was added to the U.S. critical minerals list in 2022, mainly because it’s vital for corrosion-resistant alloys and U.S. supply is moderately at risk. But zinc also has a foot in the agriculture world as a micronutrient. Zinc sulfate is commonly added to fertilizers or animal feed in areas with zinc-deficient soils, as it’s essential for plant enzyme function and animal health. The volumes are much smaller than N, P, or K fertilizers, but in a way zinc’s inclusion on the critical list highlights how even minor nutrients can be crucial. The U.S. is more than 80% import-reliant on zinc, with major suppliers like Canada, Mexico, and Peru. A disruption in zinc trade would primarily hit construction and industrial sectors, but there could be ripple effects in agriculture (e.g. higher costs for feed supplements or agronomic additives). The broader takeaway is that the web of inputs that sustain agriculture includes some less obvious minerals – from selenium (for livestock feed) to copper (used in crop fungicides and also on the critical list for its electrical uses). Keeping an eye on these “supporting” elements is part of a holistic approach to food system resilience.

In the updated critical minerals list, potash’s absence in 2022 was a glaring gap from an agriculture perspective, one that the executive order aimed to fix. Phosphate’s absence is next on the agenda, if industry has its say. The inclusion of zinc and nickel in 2022’s list shows an expanding view of criticality that edges closer to including agricultural considerations. Food production doesn’t usually drive critical mineral policy – national security discussions tend to focus on fighter jets and electric vehicles, not cornfields – but that mindset is evolving. The experience of the pandemic and the Ukraine war taught hard lessons about the fragility of supply chains for even the most basic commodities. Empty supermarket shelves and exorbitant fertilizer bills both proved how global shocks can hit home. So we may see the agriculture lobby and the national security community finding common cause in pushing for “food system minerals” (like potash and phosphate) to be treated as strategic assets.

Stakeholder Impacts: Farmers, Retailers, Policymakers, and Agtech Investors

A shift in policy around critical minerals inevitably creates ripple effects across the agriculture sector’s stakeholders. Here’s how different groups are likely to feel the impact of potash’s new status:

- Farmers: America’s farmers stand to gain from any improvements in fertilizer security. In the near term, the critical mineral label doesn’t lower prices, but it raises awareness at the highest levels of government about the pressures farmers face. That alone is meaningful. When fertilizer supply issues come up in trade talks, strategic stockpile plans, or infrastructure bills, officials will remember that potash is a “critical mineral” and thus merits support. Over the longer term, if domestic production increases and supply diversifies, farmers could see less extreme volatility in input costs. A more stable potash market helps farmers plan rotations and fertilizer applications with fewer nasty surprises. There’s also a psychological benefit: knowing that the government views what they do (growing food) as part of national security can bolster farmers’ confidence in their advocacy efforts – it’s easier to ask for help or sensible regulation when your work is acknowledged as essential. Of course, farmers will be watching closely to ensure that being on the critical list doesn’t lead to new export restrictions or market manipulation that might inadvertently raise costs. But overall, farmers gain an ally in the federal government in securing the lifeblood of their soil.

- Agricultural Retailers and Fertilizer Distributors: These stakeholders operate at the choke point between global supply and on-farm delivery. For them, potash’s critical mineral status could bring more predictable logistics and inventory management. Government focus might translate to improved transportation infrastructure for fertilizer (e.g. prioritizing rail capacity or port access for critical inputs during crises). If new domestic mines come online, retailers could have local sources to buy from, reducing lead times and freight costs. During the 2021–2022 fertilizer crunch, retailers sometimes had to ration sales or delay deliveries; a sturdier supply chain means happier customers and steadier business for them. Retailers also might see expanded services – for example, if the government ever sponsors a strategic reserve or a financing program to buffer fertilizer stocks, retailers could be key partners in storing and distributing that reserve. On the flip side, retailers will need to stay agile: as policies evolve (tariffs, sanctions, etc.), they must adjust import sourcing quickly. They’ve learned from recent experience that geopolitics can upend their procurement; the hope is that with proactive policy (like identifying potash as critical before a crisis), they won’t be caught off guard next time.

- Policymakers and Government Agencies: For U.S. policymakers, adding potash to the critical minerals list broadens the mission of economic security to explicitly include food production. Agencies from the Department of Agriculture to the Department of Defense will now coordinate on ensuring fertilizer availability – an interdisciplinary approach that hasn’t been common in the past. We can expect more geopolitical analysis of fertilizer in intelligence assessments and more diplomacy aimed at keeping fertilizer trade flowing. (Indeed, in 2022, U.S. diplomats quietly worked to exempt fertilizers from certain Russia sanctions to avoid exacerbating food insecurity abroad.) Lawmakers are also likely to take up related issues: streamlining mining permits (a politically charged topic, balancing environment vs. development), funding R&D in alternative fertilizers (like nutrient recycling or biofertilizers to reduce reliance on mined minerals), and considering whether the Defense Production Act should be invoked to support fertilizer manufacturing in emergencies. Critical mineral status gives potash a seat at the table in all these discussions. It’s a shift towards thinking of food security as part of national security strategy, which could eventually lead to policies like a “Strategic Fertilizer Reserve” analogous to the Strategic Petroleum Reserve. That idea is speculative, but no longer outlandish in the post-pandemic world.

- Agtech Investors and Innovators: The venture capital and startup community in agtech may find new opportunities in this policy environment. When the government declares a commodity critical, it often sparks innovation to reduce dependency on that commodity. In the potash realm, this could mean investing in technologies to use potash more efficiently or find substitutes. For instance, agtech startups working on precision fertilizer application (using AI and sensors to apply just the right amount of nutrient to each part of a field) become even more valuable if potash is scarce or costly – their value proposition of “do more with less fertilizer” directly addresses a national priority. Likewise, companies exploring novel fertilizer ingredients (such as extracting potassium from alternative sources like certain brine waste, seawater, or even potash-rich volcanic ash) might get a second look from investors or grants. Even biotech firms that can engineer crops to be more efficient at potassium uptake or tolerant of lower potassium soils could see a boost in relevance. Agtech investors often chase the big trends, and right now supply chain resilience and climate-smart agriculture are big trends. Potash’s critical designation sits at the nexus of those: it’s about making agriculture resilient and sustainable. Don’t be surprised if you see more startup pitch decks mentioning “critical minerals” in the context of farming, which a few years ago would have sounded odd. In essence, this policy shift could catalyze a wave of agtech aimed at decoupling food production from volatile global inputs.

Food Security, Climate Resilience, and National Security Intersect

Designating potash as a critical mineral might seem like a bureaucratic footnote, but it symbolizes a broader realization: food security is a pillar of national security. The COVID-19 pandemic and the Ukraine war both revealed vulnerabilities in the global food system – from empty shelves and price spikes to nations restricting exports of grains and fertilizers to protect their own supply. For the U.S., a country blessed with agricultural abundance, it’s easy to be complacent. Yet, the modern farm is tightly integrated into global networks of inputs and outputs. A hiccup in a mine 5,000 miles away can translate into a poorer harvest in the American Midwest, which in turn can affect global grain markets and even foment unrest abroad. Policymakers are beginning to connect these dots, treating the stability of input supplies, like fertilizer minerals, with the same gravity as energy security or cybersecurity.

There’s also a climate resilience angle. Climate change is expected to put new strains on agriculture – more extreme weather, shifting pest pressures, etc. To maintain yields under these stresses, a reliable supply of fertilizers (and the ability to use them judiciously) will be crucial. At the same time, climate policy is pushing agriculture to become more sustainable, which includes optimizing fertilizer use to reduce runoff and nitrous oxide emissions. In a future where every input must be used efficiently, a scarce resource like potash will be managed with precision. Having it designated as critical could spur investment in efficiency technologies and closed-loop systems (for example, capturing nutrients from manure or food waste and recycling them as fertilizer). That dovetails with climate goals by reducing waste and the need to mine virgin material. Additionally, localizing some potash production (with cleaner, modern methods like Michigan’s planned electric-powered solution mine) can cut the carbon footprint associated with transporting heavy fertilizer halfway around the world. In short, a resilient fertilizer supply chain is part of a resilient climate strategy, ensuring we can feed a growing population in a warming world without interruption and with lower emissions.

Finally, the national security establishment is increasingly viewing resource dependence in holistic terms. It’s not just about critical minerals for fighter jet alloys or batteries for tanks; it’s also about the fundamental capacity to sustain the population and the economy in a crisis. In World War II, American war planners worried about rubber supplies and set up victory gardens for food – today’s equivalents might be lithium for batteries and potash for food. A nation that cannot feed itself or maintain its food exports loses strategic influence and could face internal instability. The critical minerals list update, guided by the Energy Act of 2020, explicitly considers whether a mineral is “essential to the economic and national security of the United States” and whether supply chains are vulnerable. Potash checks those boxes: it’s essential for the agricultural economy, and its supply chain has weak points. By elevating potash (and hopefully phosphate to follow) as critical, the U.S. is essentially broadening the definition of strategic resources to include those that underpin food and agriculture.

In conclusion, the inclusion of potash on America’s critical minerals list – spurred by a Trump-era policy initiative and continuing into the present – is a recognition that fertilizers are the invisible backbone of food security, and thus national security. The implications range from the mine shaft to the farm field: new domestic mining ventures, more attentive trade policy, potentially steadier prices in the long run, and a wave of innovation to use nutrients smarter. American farmers and agribusiness, often far removed from the halls of geopolitics, are finding their concerns about fertilizer echoed in strategy discussions in Washington. The critical mineral designation alone won’t solve supply risks overnight, but it cements a commitment to ensure the country’s food supply is never held hostage by foreign quarries or capricious markets. In an era when climate change and geopolitical rivalry threaten unprecedented disruptions, that commitment is timely. Potash may be a humble salt, but it now sits squarely at the intersection of earth, food, and security – a reminder that in our interconnected world, even the soil beneath our feet has a strategic story to tell.